The builder’s perspective on consumer crypto

Learn from the top consumer crypto founders about the biggest opportunities and challenges of developing in the space.

Max Segall and Will Collier

|Nov 14, 2023

Seeing someone we forgot? Reach out, we’d love to add them!

Disclaimer: While our aim here is to share our learnings about the space, Decent and Privy are both actively engaged in building here, accordingly our vision is colored by our work, as well as the products we spend time building with.

TLDR

We’re seeing a new wave of developers building delightful consumer apps on decentralized infrastructure

The most prominent “consumer crypto apps” typically prioritize making onboarding, account funding, and activation flows as seamless for crypto newcomers as possible

Abstracting wallet interactions, gas, and bridges/onramps away from users is a priority among the 20 leading consumer crypto builders we surveyed for this piece

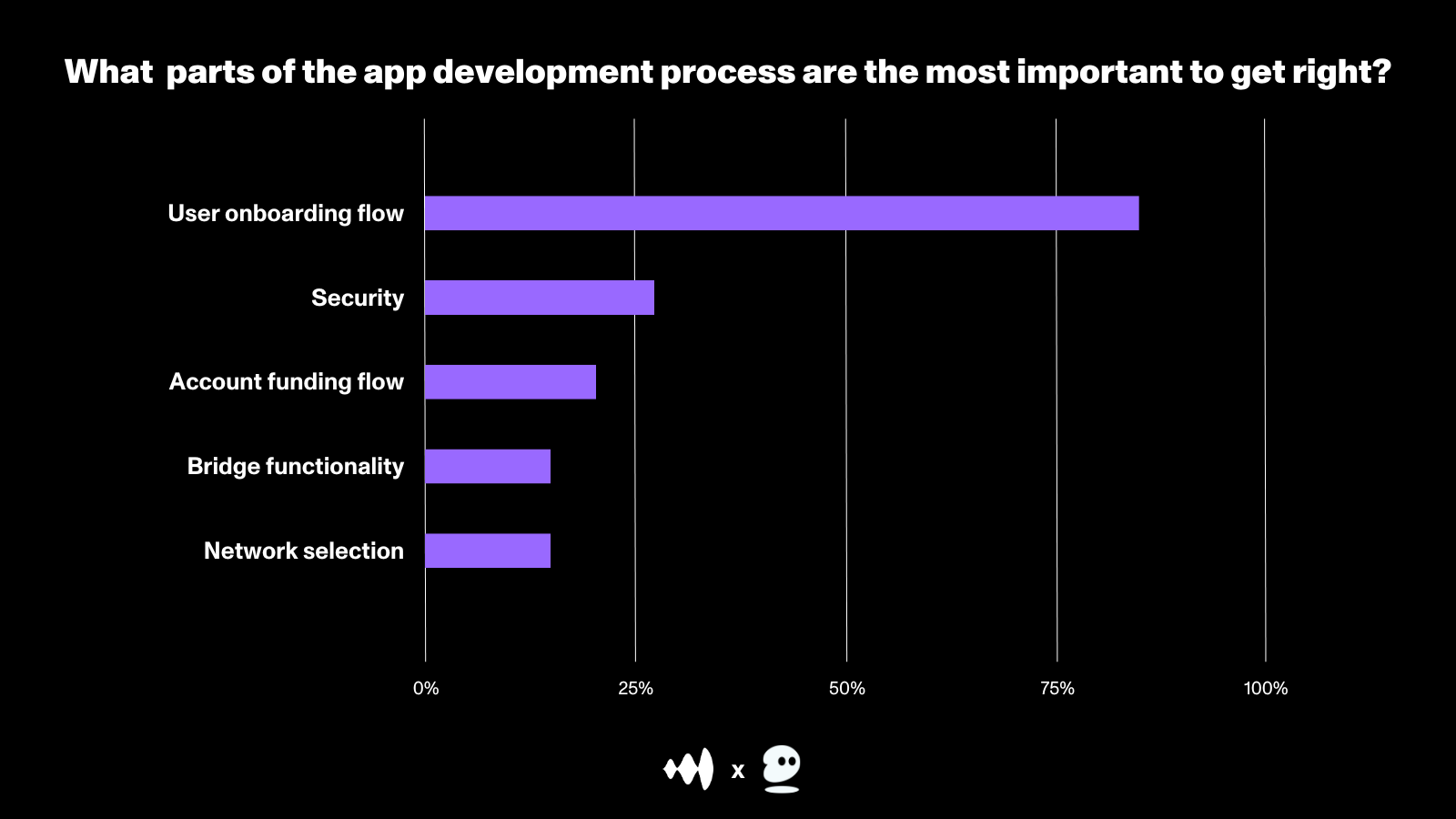

75% of respondents view the user onboarding experience experience as the most important part of the app development process to get right, with security and account funding as close runners up

As more apps like Friendtech, Farcaster, Zora, and Blackbird hit the market, we should expect this consumer crypto wave to continue accelerating

You’ve likely heard a lot about “consumer crypto” these last few weeks, and for good reason! Onchain summer brought with it a new wave of fun, engaging B2C crypto products. Apps like Friendtech and Blackbird have started to show our market what is possible when you combine delightful app experiences with decentralized systems. These apps and others like them have catalyzed a wave of development that prioritizes seamless user experiences that can entice mainstream users to explore our market.

Here's what we've learned talking to and working with ~20 leading consumer crypto builders.

What great looks like in consumer crypto today

To establish a baseline, what qualities define some of the best consumer crypto experiences today?

No technical knowledge required

One notable difference between this new generation of apps and those of prior cycles is that many of these projects cater to mainstream audiences. Users onboard with familiar methods like email or social logins (often in addition to wallets), they pay with credit cards, they don’t need to worry about things like network compatibility or gas.

Mobile-first

>50% of internet traffic comes from mobile devices (and growing), and crypto builders are catching on. Many of the most exciting consumer crypto apps feel more like Instagram than they do like Curve. Thanks to companies like Showtime or Blackbird providing exemplary native experiences or the host of benefits unlocked by PWAs, more founders are building app experiences for users on the go.

Social

Friendtech got a lot right, notably their incorporation of viral social loops. Users can only sign up if they receive an invite code from someone they know. The app bootstrapped its social graph by having users connect their X accounts as a part of the sign in process. The app’s core user flow revolves around group chats with friends.The cross-app composability that crypto introduces stands to make social experiences in crypto even stickier than those in web2 (e.g., Zora and Lens)!

Mixed media

For the first time, we’re seeing crypto apps incorporate forms of media content like video streaming and interactive maps using smartphone GPS to further boost engagement. One of the best examples of this is Unlonely’s Love on Leverage Series, which allows viewers to stream virtual blind dates. The streams include live commentary from the founder, and a vibrant participant chat with a running bet on whether the pair will agree to a second date at the end of the show.

What the builders are saying

We spoke with 20 leading consumer crypto builders about the biggest challenges, opportunities, and trends in the market. Below we’ve compiled their data and feedback. It paints a picture of the consumer crypto landscape and what steps need to be taken to move forward. Any sentences in quotation marks are direct comments from surveyed builders (a full list of participating companies can be found at the bottom of the piece).

Transaction Experience

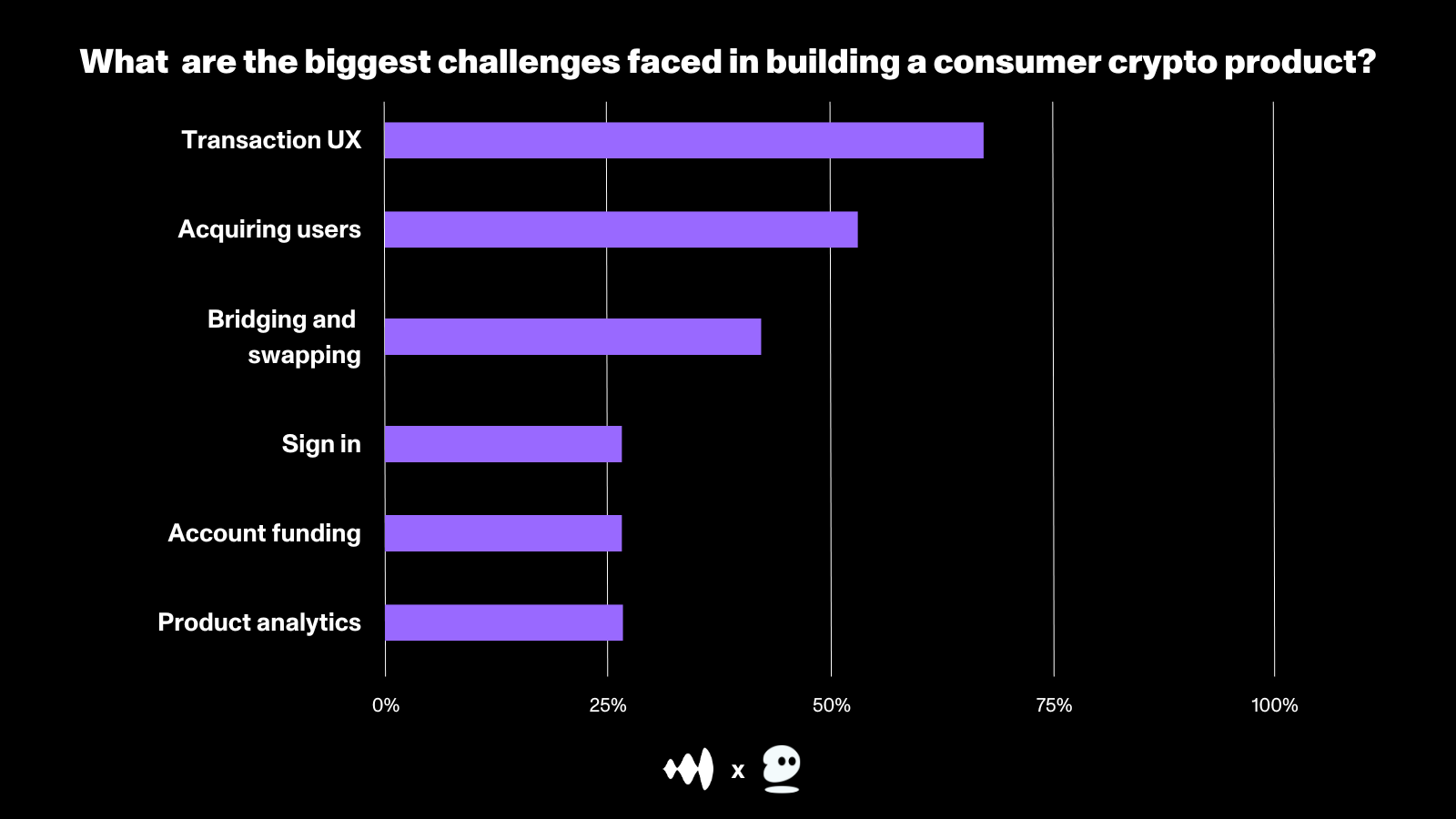

Every (onchain) action in a crypto application is a transaction. At a minimum, transactions require paying gas. To date, this has meant getting a wallet, onramping assets, and getting them on the right chain, creating a financial and technical barrier to adoption. Historically, most crypto apps have either been shallow uses of blockchains, or complex interactions for technical users. It makes sense that ~75% of consumer crypto founders agree transaction UX poses the biggest challenge to building a great consumer crypto app. Respondents that elaborated said things like:

On transaction UX:

“As we are building onchain commerce, we need to ensure our collect and checkout UX is seamless for rapid payments.”

“The next great problem is ‘bridging’, but really I think we should never have to use that word, or ‘select a network’. That should all happen auto-magically in the background.”

“Transaction UX on mobile is bad and bridging [sucks]. Creators need to have ETH in wallet to deploy smart contracts which makes things slower.”

“TXN fees are also way too high and unpredictable”

“We've now gotten L2s cheap enough. Next up feels like we need to solve wallets, in particular making them easy to setup and recover and making them able to transact across every L2.”

Transaction experiences can be marred by a litany of factors like having to bridge to the right tokens to pay, and costs and fees being too high or fluctuating volatilely. In our ever-expanding multichain world, bridge abstraction will be a 10x unlock for consumer crypto user experience and adoption.

(Note to the reader – This is the core set of challenges that Decent was built to solve: enabling users to pay in any token at the point of purchase no matter what chain the application is on.)

According to a spring 2023 survey conducted by Decent, 80% of users walk away from a transaction if they don’t have the right token on the right chain (instead of going to use a bridge). But the future is bright. Respondents pointed out that, alongside progression in crosschain payment infrastructure, there have been exciting developments across the account abstraction infra landscape to improve the gas funding piece of the transaction UX. By working with smart accounts, developers can fund gas fees on behalf of their end-users (particularly on L2s where gas is often negligible) in order to streamline time to first onchain action, particularly for users who don’t have experience with crypto.

The Activation Funnel

Consumer applications need to be easy to use and quick to access for people unfamiliar with crypto if they want to scale to mainstream audiences. The typical crypto app users funnel includes: user acquisition, wallet sign in, account funding, and activation. Each of these steps presents challenges, and each is only possible if a user completes the proper step before it without dropping off.

User acquisition has been challenging for many in the bear market, as many users have grown weary of over-financialized crypto apps. Acquisition is the start of any onboarding funnel, and something that will be covered later on down this piece. Consumer founders answered that making more engaging application experiences was the most important step that we can take to grow adoption. More interesting experiences, especially non-financialized and mass-appealing ones, will drive more user acquisition.

Seamless Onboarding

There’s a reason why >75% of respondents view user onboarding as the most important thing to get right when building a consumer app. Onboarding complexity has historically been a massive barrier to adoption in crypto, and when potential users drop off at the onboarding flow, they likely won’t ever make it back.

Improved onboarding flows have played a big role in the recent uptick of well-performing consumer applications like Friend.tech, Courtyard, Draw.Tech, and more. Each of these apps give users the ability to create an account via familiar methods like email and social login, provisioning embedded wallets for users under the hood.

(Privy was built to make it seamless to onboard all users to onchain apps, regardless of their experience with crypto)

Account Funding

Account funding, or getting access to assets to use in the app, was identified as the most important part of the app flow to get right by ~25% of builders. Although the consumer crypto cohort feels good about the state of user onboarding, it seems like there’s still work to do on the account funding front. Once a user has a wallet, they still need to fill it in order to proceed with any transactions or interaction. One respondent wrote “...there's a lack of good tools to let web2 users transact seamlessly once they have an account. Because of this, users often need to use clunky funding tools, or CEXs, which leads to mistakes (sending funds of the wrong currency or on the wrong network) and frustration (declined fiat transactions, delays, etc).”

Security Matters

Seamless UX cannot be separated from the need to secure assets, particularly as onchain assets get more valuable as users engage with apps 25% of our respondents identified security as the most important thing to get right in building a great consumer crypto app.

The best apps do a good job presenting friction when it makes sense, allowing users to get in the door easily, and progressively bolster account defenses with tools like linking additional sign in methods and 2FA recovery passwords when needed. Security work is never-ending, and we’re excited to see developers balance UX and security, as both elements are essential for mainstream adoption in the long-run.

Infra vs. App Cycles: Give us more apps!

Common hypotheses around crypto building have involved notions of infrastructure and application phases that ebb and flow on a steady upward growth trajectory. Apps inform new areas where more infrastructure is needed to be built, which breeds new applications and use cases, which exposes new holes in the infrastructure, and so on and so forth. Beyond anything else, >50% of respondents highlighted the need for continued experimentation and more consumer apps in crypto. Infrastructure can only get us so far if it is not used to power new projects.

On better, more engaging application experiences, our respondents said:

“Everything else in the above list is unnecessary. We just need more and better consumer apps.”

“We need app experiences that make all of these powerful tools and infra usable by a non-eng user base.”

“I think #1 thing is unique use cases unlocked by crypto. I believe people will jump through hoops to use products they want to use. Ex. the entire PFP craze had everyone going through clunky UX to just mint NFTs for hundreds of dollars.”

“People do all sorts of silly things if they're interested in something. eg. waiting in line for an hour at a store. I do think the terrible state of crypto UI is a bad thing, but I think it's less of a problem than the lack of apps that people actually want to use within crypto.”

While infrastructure and having the right tools to make more seamless experiences are important, applications won’t flourish if the substance of the experience is not encapsulating. Having proper infrastructure and building a good application in some cases go hand in hand; as it gets easier to develop applications on crypto rails, more and more creative and talented developers will attempt to do so. Application pitfalls that were called out by respondents included many skeuomorphic concepts (“_____ but with crypto”), errant injection of financialization into concepts (“_____Fi”; SocialFi), and a split opinion on the efficacy of applications that reward users for being early, inviting speculation.

Fortunately, we’re seeing engaging consumer experiences released each day, uniquely enabled by decentralized systems, but built for a mainstream audience!

What’s Next?

This peek into the current state of consumer crypto is just part 1 of 3 resources we’re planning to distribute together for the benefit of the building community. Furthermore, stay tuned for imminent product updates from both the Decent and Privy teams pertaining to account funding and onboarding. If you have any questions or comments about the material provided, we would love to hear from you on Twitter!

Huge thanks to participants from the following leading consumer crypto brands:

Base

Blackbird Labs

Co:Create

Courtyard

Crowdmuse

Fantium

Hypeshot

Icebreaker

Orb

Prohibition

Slow Rodeo

Station Labs

The World’s Largest

Toucan

Vessel

Internet Game

T2 World